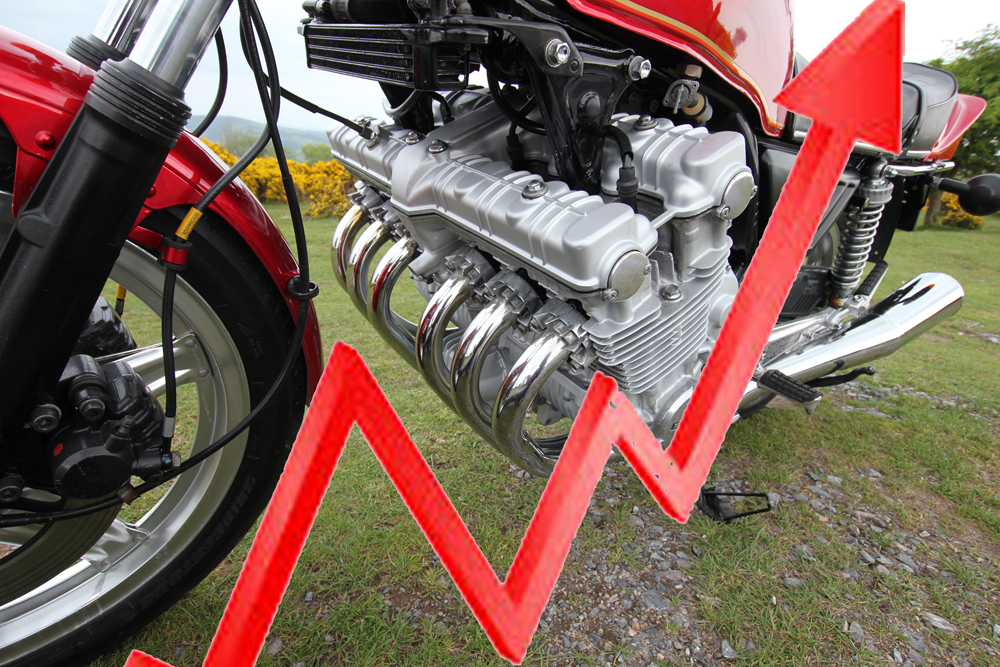

Investing during Covid and Brexit

Whatever your views of the impacts of Covid and Brexit on the UK, they have made investment decisions challenging. The stock market has suffered and had a bounce back too. The usual FCA approved products have delivered minimal, if any, returns. Interest from banks is well below inflation, so any savings are being eroded. New tax laws and unwilling lenders have made property far less attractive than it once was. Confusion about who is allowed to own property and under what terms have also made UK property less attractive to foreign investors. There is very little safe haven investing in these challenging times and there’s now only more unanswered questions. However, tangible assets have done very well during lock down and post Brexit. One of the best performing tangible assets is classic motorcycles.

Classic motorcycles perform very well

Why, when everything is so unstable, are classic motorcycles performing so well? Classic cars, wrist watches, whiskey, wine and art have all set the tone ahead of motorcycles. It’s a way of investing that now has history in the UK and Europe, especially since the banking crash in 2007/8. Prior to the banking trauma of this period, classic cars were re-discovered by investors as a fun way of holding money instead of parking it in the bank. After 2008 they became as serious as property and were respected as any part of an investment portfolio. Over the last twenty years classic motorcycles weren’t really thought of as a serious investment. They were thought of as an enigma, dirty and the territory of oil soaked and grubby individuals.

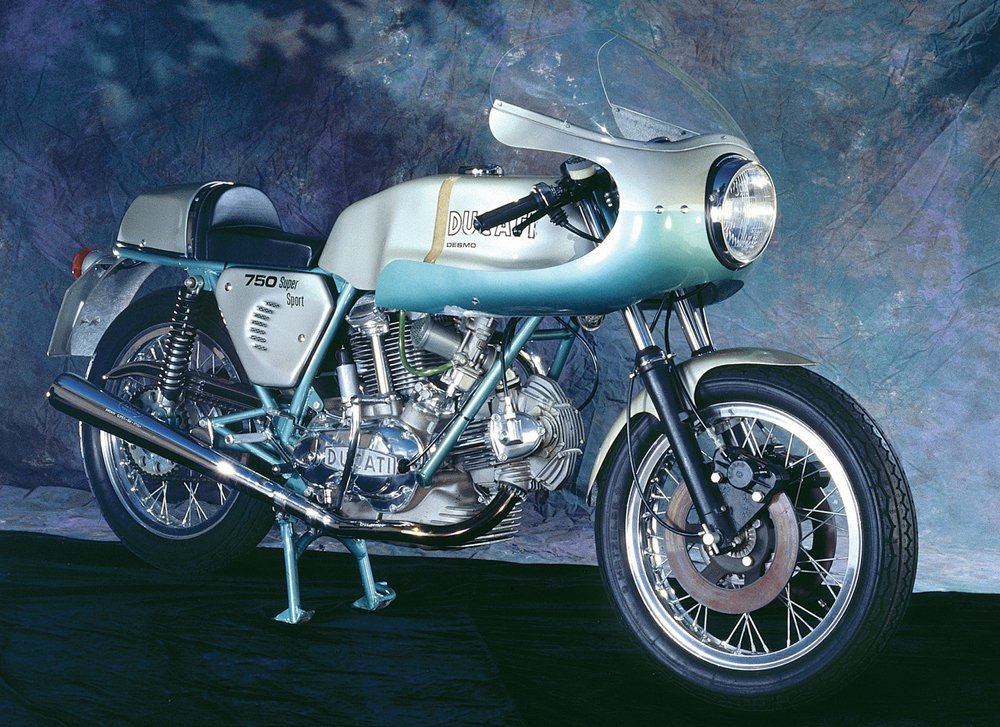

Due to this outmoded image, motorcycles weren’t taken seriously as a tangible asset, let alone a safe haven asset. Consequently, the classic motorcycle market is trailing the classic car market by at least fifteen years in terms of values. There is also an enormous demographic push for people in their forties, fifties and sixties to now buy the motorcycles of their youth. These new investors are only just beginning to understand how rare these beautiful motorcycles are. To get an idea of how serious this driving force is, read this article we wrote way back in 2015 here. This phenomenon was not limited to the UK, it was a global phenomenon. The global increase in motorcycle sales between 1975 and 1983 was sparked by four factors.

- The reliability of Japanese motorcycles, over British motorcycles.

- The high cost of car insurance for car drivers under the age of twenty one.

- The availability of hire purchase for new motorcycles for any working person over the age of eighteen.

- The ease of access to motorcycling. No tests, just a pair of L plates.

Although lots of new motorcycles were sold at this time, very few of the iconic motorcycles were produced and there are very few investment grade examples of these motorcycles surviving today. These motorcycles are incredibly rare compared to classic cars and there are a lot of people now hunting them down. The other driving factor for price increases of classic motorcycles is that they are now being taken very seriously as a tangible asset. Classic car investors are realising the great value these motorcycles offer without the issues of left hand or right hand drive and also because the bikes take up less space than the cars.

Safe haven assets-

Investing in property

Property has always been viewed as a safe haven asset, especially London property. The instability of Covid has made investors question whether or not city life is where the future lies. There are many other factors, such as new tax rules, making property far less attractive.

Investing in the stock market

The stock market has proven itself unreliable in such testing times and investors have been seeking alternative investments that are robust. Investors are seeking out the next new safe haven asset and classic motorcycles are proving themselves to be exactly that.

Investing in gold

Investing in gold has been profitable at the beginning of this pandemic, but it is clearly a manipulated market to make the US$ look stronger than it is in reality.

Investing in art

Art has done very well in these trying times as you can read here. This article also demonstrates how art is doing well if it is sold online. It certainly seems that businesses that have adapted to life online are thriving, if they work with integrity.

Investing in wrist watches

Wrist watches have done extremely well over the last two decades, because they are pleasurable, beautiful, easy to move from place to place and easy to store. During the Covid crisis they have done very well for businesses that have organised themselves to perform well online (there’s another theme going on here). You can read more about this in this article here.

Investing in fine wine

The fine wine market appears to have had a record breaking year during the pandemic, as this article claims. Most owners of wine never take possession of it and the majority of the business is conducted online. Investors from China have really helped this market, but the fraudulent behaviour of one high profile individual has damaged confidence. In spite of this particular problem, wine has done very well especially during Covid and prices will now increase due to Brexit.

Investing in classic cars

Classic cars have been a little stagnant for the last two years, simply because the market has been rising fiercely for the previous eighteen years. The market has been taking a well-earned breather after unprecedented returns. China is already slowly starting to enter this market and it will have a profound effect on values and demand alike. Prices have held up very well during Covid with some new investable models making themselves known. Suppliers that have developed their online business model have done very well and those that haven’t are struggling. You can see how this market is doing here. We also reported about this happening two years ago in this article here.

Investing in classic motorcycles

Classic motorcycles have proven themselves to be excellent value and prices have increased during Covid substantially. Demand is increasing from classic car owners, as well as from the demographic forces described above, and in the link above. Car owners are waking up to the excellent value offered by the bikes. They offer full access to a truly global market to investors, as there is no left or right hand drive. They take up very little space, compared to cars and are much easier to move from location to location. Some machines are like a work of art, with their incredible form and function working in perfect harmony. Another theme is how well all of the providers of these assets have thrived if they have moved their businesses online. The Motorcycle Broker has been an online service since 2013. We do have premises and we do have socially distanced appointments for customers, but this is a storage facility, workshop, paint shop and chrome plate shop. Every motorcycle that comes through our doors is properly set up for our customers so we can offer a one year unlimited mileage warranty. All of the work on our motorcycles is done in-house as we understand the machines we work with and there are very few people who can set these motorcycles up properly. We are a one stop, end to end service, we pride ourselves on our work and reputation. We ensure that every motorcycle we supply is one of the few investment grade classic motorcycles, so you won’t ever experience any nasty surprises from our classic motorcycles. We even supply a full due diligence file proving that your classic motorcycle is investment grade.

Brexit has increased prices

Our trade “deal” is effectively a no deal Brexit. Tariffs and VAT have been added to motorcycles from the EU ranging from 5% to over 30% in total. There are nowhere near enough investment grade classic motorcycles to get close to satisfying demand in the UK alone, but this is a global market. Britain has been exporting classic motorcycles to outside of the EU for many years, so prices outside of the Eurozone are too high to import from there, and there are tariffs and VAT to pay on vehicles which are third countries, so we will now have to pay the extra for motorcycles from the EU. Prices have now already increased by up to 30% and investors are happily paying this, as the bikes are still offering excellent value and plenty of headroom. These machines have a few decades of great returns for investors and China is already slowly entering the market after nearly quarter of a century of not being allowed to import motorcycles. That has now changed and China is the largest motorcycle market on the planet, selling 20,000,000 new motorcycles every year. The Chinese investor loves tangible assets and motorcycles are destined to start being collected by smart Chinese investors.

Tax-free investing

Classic cars and classic motorcycles offer tax-free investing if they’re part of a private collection. They attract no CGT or income tax and it would be very difficult to change the status quo for various reasons I won’t go into here. If you want to invest safely and tax-free in classic motorcycles contact The Motorcycle Broker on 01806 865166 or 07971 497615 or Email: [email protected]

- Most collectible Ducati 916 SP - June 20, 2024

- Classic Motorcycles: To ride or not to ride? - June 17, 2024

- Classic Motorcycles: To ride or not to ride? - June 17, 2024

Leave a Reply