We have crunched the data over the holidays and the 2021 return on investment for classic motorcycles is really rather uplifting. There’s still a long way to go as this market is so much less developed than the classic car market. So what does all this data tell us and where do we look to understand the classic motorcycle market? Fortunately, the classic motorcycle market is less developed than the classic car market which means that the car market will foreshadow the classic motorcycle market. Can these motorcycles continue to deliver such incredible tax free profits? Has the market peaked? Or are we only at the beginning of a relatively new tangible asset in a world where fiat currency is being eroded? Let’s look at these charts and try to understand what they mean, you can see them at https://themotorcyclebroker.co.uk/classic-motorcycle-investment/return-on-investment-classic-motorcycles/

Brough and Vincent

Brough Superior SS100 have done very well with prices increasing 36% after a year of taking a breather and not increasing last year. These are very rare machines and considering they have been increasing over Covid and with the impact of Brexit, demonstrates that these are a great investment. Since 2010 the cumulative increase in value has been 500%, try getting that from an ISA and it’s all tax free. Broughs have a long way to go to catch the American Crockers which sell for around US$1,000,000. Vincent Black Shadows have had a bit of a breather, but they will pick back up again, it’s just the way the market works, motorcycles increase in value, have a breather and then take off again. If you bought a Vincent Black shadow in 2020 you won’t have seen any increase in value last year. Since 2010 they have delivered investors a tax free 133% profit which is pretty reasonable.

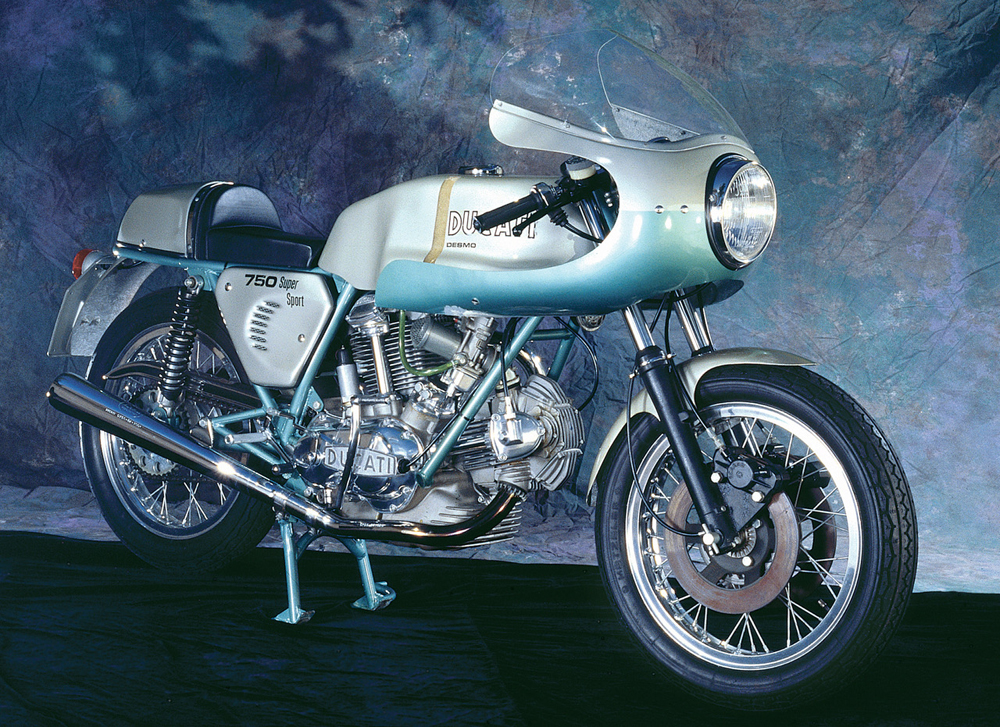

Ducati Bevel Drives

There is more data from other Bevel Drives and they are performing very well too. I’ve only published the Green Frame and 1975 750 and 900SS. The Green Frame is getting towards the pinnacle of classic motorcycle investment and have a long way to go. These are the Ferrari GTOs of classic motorcycle investment and will climb over the £1,000,000 mark, but we just cannot predict exactly when. Cheap ones have been sold and the owners will regret what they’ve bought, because they will never get those essential missing parts for their machine and it won’t ever be a motorcycle of great value. Investment grade examples are changing hands very rarely and they always sell for what the owner decides is the value, delivering a profit of 22% last year. These machines are in very strong hands now and investment grade examples are extremely hard to find, although there are plenty which are not of that quality in the market. Buyer beware! The 1975 750 and 900SS is now starting to catch on the Green Frame and they are rarer. Some of the ground is now being made up and I can see this machine overtaking, or matching, over time the iconic 1974 750SS. They increased in value by 47% which is a serious price increase. Since 2010 the Green Frame has delivered profits of 588%, the 1975 750SS 2,344% and the 1975 900SS delivering 2,650%. Although these profits are dream like values, you haven’t seen anything yet and all three of these machines will seriously deliver incredible profits over the coming decade.

Ducati 916/996 SP/S series

The 916 Strada and 996 SPS are taking a breather due to Brexit. These aren’t quite as desirable as the 916 series or the Foggy Replica and I will go into the anomaly around the Foggy Replica shortly. The Strada and 996 SPS now cost about an extra 30% to import due to VAT, tariffs and paperwork and investors are deciding to buy the more desirable and rarer 916 series when they have to pay that much more for their machine. People will get used to the price increase and will just end up paying the extra. Unfortunately nearly all UK examples need so much work doing that the 30% extra cost of importing a machine is soon swallowed in remedial work required to UK examples. Don’t be fooled by shiny UK examples, once the bodywork is removed and the investigatory work is completed the workshop costs are astronomical, as you can see when we had to work on this UK 1995 example. The best examples of these machines are on mainland Europe, I have been buying these machines since 2004 and we are very experienced with them. The Foggy Replica is showing a 33% increase, however it had dropped 14% the year before due to one UK dealer having three of them in stock at once. I have always said that the Foggy Replica is not as stable as other models because it was only sold in the UK, which removes export opportunities and Brexit has completely shut down any such hope of selling these into the world market. The Factory Replica series 1 is a rarer machine, with only 150 units built, and is known globally so there is far more demand for this machine. The 916 SP series has increased by 28% and did not fall by 14% the year before and is performing admirably. Early examples are seriously sought after and the 1994 916 SP is the collector’s dream with prices rising faster than any other of this series. The cumulative price increases of these machines is impressive, since 2010 the Strada would have delivered 900%, a 1995-96 916 SP 611%, the Foggy Replica 433% and the 996 SPS 317%. These figures are so much better than almost any FCA regulated product, they offer such joy from their ownership and all profits are tax free.

Honda, Kawasaki and Laverda

The Honda CBX1000 has delivered a 30% increase in value, like the 916 SP, due to Brexit and also due to age. They are now at a point where the plastic on the timing chain tensioners is so broken down, due to age, that the engines require a full rebuild. Also the cylinder heads need the valve guides replacing, due to age and all of this work is very costly. Beware of who has done the work to any CBX1000 as they really do need the attention of engineers who seriously understand them and who are experienced with these machines. However, delivering cumulative profits of 333% since 2010 they have done very well, but promise far greater future profits once properly sorted out. The same is true mechanically of the Laverda Jota, they have serious age related issues and other problems that began the day they were built in the factory. These motors require people who have a lot of experience with them and understand what to look for. Cylinder heads are usually warped, piston rings widen their groove in the pistons, valve guides are falling to pieces due to age, inlet valve seals need replacing (they don’t have exhaust valve guide seals), heads crack due to age and the valves will now have pushed the seats deeper into the cylinder head. That’s just for starters, there’s a whole myriad of problems with Laverda which can all be remedied, but it’s very expensive, time consuming and often unmasks a host of other problems. Honda Sandcast CB750 KOs have performed very well and will continue to increase in value as owners discover there is no such thing as a cheap Sandcast. Although they only increased by 11% last year, they are long term performers, as they have delivered cumulative profits of 900% since 2010. It’s closest rival, both in its day and now, The 1972 Kawasaki Z1 900 has only delivered cumulative profits of 200%, but they are a direct rival to the Honda Sandcast, there is a direct correlation between these two motorcycles. Serious collectors are paying far more than the price of a Sandcast Honda for one of the first 1200 Z1s. This all adds up to a motorcycle that will increase severely in price in the coming years, it has quite a way to go and there is more and more desire for these stunning 1970s icons. They really are the equivalent of the Aston Martin DB4 of the classic motorcycle world.

MV Agusta 750S and America

The MV Agusta has performed very well and the 750 Sport is now starting to seriously chase the Ducati Green Frame. These are incredible machines and will probably run parallel on price with the Green Frame very soon. There’s plenty of headroom for much greater profits as these machines are now being discovered by investors and with only around 150 investment grade machines left worldwide, they have become extremely difficult to source. With the link to Colombo, the iconic Ferrari engine designer who designed the GTO motor, these motorcycles will become vintage Ferrari owners’ must haves in the coming decade. The America is an iconic machine but has never performed as well as the 750 Sport, because the 750 Sport just looks so gorgeous with that hand beaten fuel tank. There are very few safe bets in any investment, but the 750 Sport is one I’d happily bet my home on.

Yamaha

Yamahas have delivered great percentage returns but they are really, comparatively, low valued machines. The HL500 is a very rare Moto cross machine and, although it has performed very well, it is incredibly undervalued. They increased 15% last year and have delivered a cumulative return of 1150% since 2010. The HL has that link to Yamaha’s racing department and the two stroke racers of the 1970s and 80s are really beginning to take off, although prices will scream away once Kenny Roberts sells one of his championship winning TZ750s. He did recently sell one of his unique Yamaha racing machines for well into seven figures, so the demand is already starting, watch this space! I think RD350LCs and RD400s will take a bit of a breather now as E10 fuel starts to demand owners rebuild their crankshafts much more regularly than before. Early XT500s delivered a return of 15% last year, but they have offered owners cumulative profits of 1400% since 2010. XS1100s have a long way to go and are an underrated motorcycle, although the shaft drive does cause unsettling, yet not dangerous, handling. Finding a really good example is more than challenging and is probably worth the effort, especially the Martini version with the full fairing.

Classic motorcycles offer fantastic investment returns

Classic motorcycles offer fantastic investment returns, certainly better than any FCA registered investments and are completely tax free. The bubble has not yet left the ground when you look at the classic car market. There’s plenty more head room for profits from these incredibly fun machines, but only the investment grade examples will deliver such profits, as I pointed out in this and many other articles. The gulf between investment grade classic motorcycles and everything else is growing by the day. Investors demand authentic and genuine machines, the real thing. In our experience only about 8% of machines in the market are investment grade and all need work doing to them. The numbers speak for themselves and these machines have a long way to go and prices will continue to rocket as people chase down tangible assets that are inflation proof and perform better than inflation. Now is a great time to get into these machines and if you want investment grade classic motorcycles, call The Motorcycle Broker. We find the correct example of the machines you desire and work with you to understand what you want from your classic motorcycle collection.

- Most collectible Ducati 916 SP - June 20, 2024

- Classic Motorcycles: To ride or not to ride? - June 17, 2024

- Classic Motorcycles: To ride or not to ride? - June 17, 2024

Leave a Reply