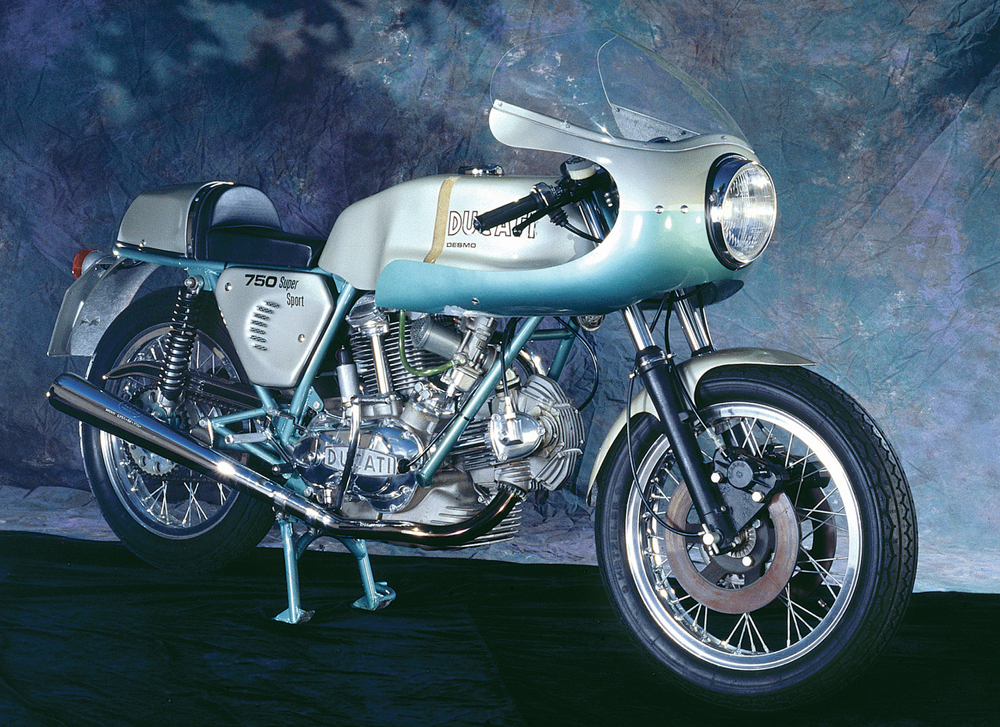

The classic cars that will increase in value are classic motorcycles and no wonder when you look at the returns. We have analysed the data with various experienced investors in the classic car market and it’s clear that the best future profits will come from classic motorcycles. When you look at the 1974 Ducati 750SS green frame, or the MV Agusta 750 Sport, you can see machines which have increased several hundred percent over the last ten years. However, they are both at a fraction of one percent of the value of the equivalent classic car. The green frame Ducati is clearly the Ferrari 250 GTO of classic motorcycles and the MV Agusta is the 1930s Alfa Romeo 8C, especially with half an Alfa 8C motor in it, of classic motorcycles.

Comparative values

The comparative values are £250,000+ for the Ducati and £150,000 for the MV Agusta, that is, if you want an investment-grade example. They can be picked up for less, but you will find that you get what you pay for and it’s far less costly to buy an investment-grade example right now. If you do try and source an example which is not investment grade in the hope that you can find parts later and bring it up to spec, you will very likely be disappointed. Read my article here about buying an investment grade 1974 Ducati 750SS “green frame “ and you will see why.

Many of these machines were extremely rare to start with, there are many fakes in the market and they had unique parts which are just not available now. Fakes are exposed by expert buyers who have access to information which is not in the public domain about these machines. Clearly, the classic cars that will increase in value are classic motorcycles.

Classic motorcycles are undervalued

Classic motorcycles are undervalued whichever way you look at it, especially when you see the meteoric rises in classic cars. Although many classic motorcycles have increased by over 400% since 2010, they have a long way to go, as they were ridiculously cheap back then and still are. Who would have guessed that the last Ferrari 250 GTO would have sold for US$70,000,000 in 2018 when one sold for US$31,000,000 in 2010 and these sold for US$3,500,000 in 1996, as you can see here?

No one would have imagined that a Ferrari 250 GTO sold in 2000 for US$6,500,000 would reach such dizzying heights five years ago over an eighteen-year period, as you can see what this one sold for in 2000 in this article here. Ferrari 250 GTOs continue to rise in the off-market as some consider a sale. The green frame Ducati, now selling for just US$300,000, is clearly the Ferrari 250 GTO of the classic motorcycle world and will clearly go into the millions of pounds in value for an investment-grade example over the next ten years.

Alfa Romeo 8C

The Alfa Romeo 8C in this link sold for £16,500,000 (US$19,800,000) in 2016, in this article here, and off-market prices are rising. The MV Agusta 750 Sport is clearly the Alfa 8C of the classic motorcycle world and investment-grade examples can still be scooped up for £150,000 (US$181,500 cat today’s rate). There are many more examples of classic motorcycles that are just a fraction of one percent of the equivalent classic car and will have to move to well beyond ten percent of the value of the equivalent classic car.

Many experts believe that motorcycles could well end up at 20-40% of the value of the equivalent classic car, just as the values are for new motorcycles. Prices for investment-grade classic motorcycles have already increased due to a demographic drive we wrote about eight years ago in this article about what is driving the prices of Japanese and Italian classic motorcycles?

Many of the classic motorcycles which are being chased down by investors are much rarer than the equivalent classic cars. Most people throughout the world started life on motorcycles through the 1970s and early 1980s, but the superbikes were produced in very small numbers. Motorcycles had a much tougher life than cars from this era and very few are left in investment-grade condition today. Demand has increased over the last thirteen years as classic motorcycles start to become a respected tangible asset, just like classic cars.

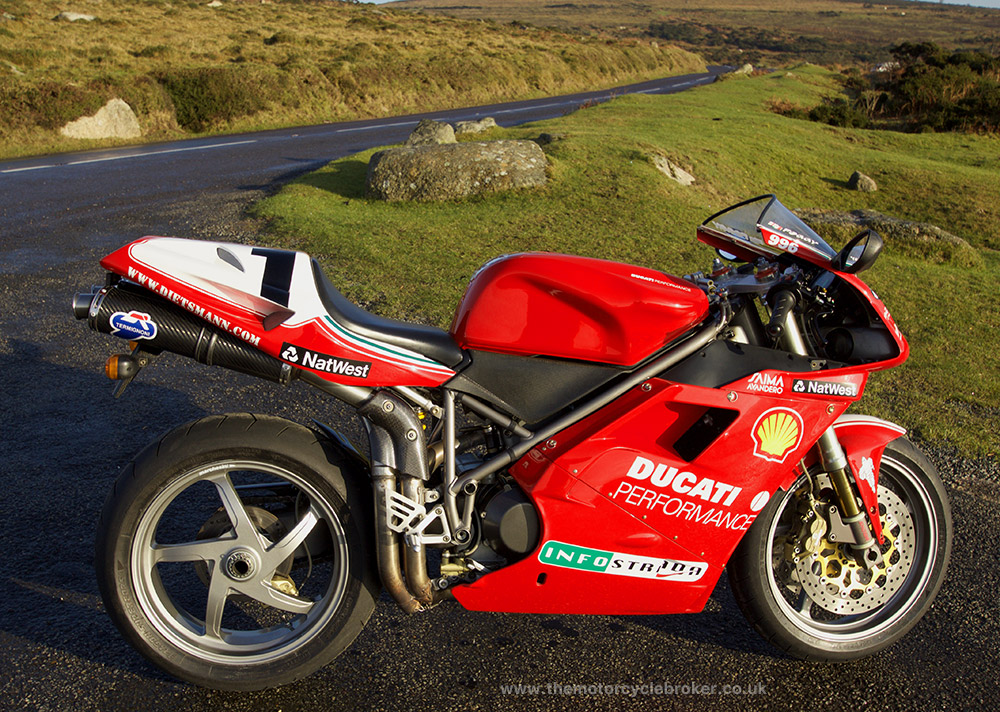

Ducati 916 SP

The Ducati 916 SP series is clearly the Ferrari F40 of classic motorcycles. Although Ducati made about the same number of the 916cc SP series as Ferrari made F40s, the Ducati is much rarer than the Ferrari. That’s because far more 916 SPs were raced, crashed, stolen and modified beyond redemption than Ferrari F40s enduring the same fate. You can read a lot more about Investing in a Ducati 916 SP 996 SPS where I go into the why’s and wherefores of the 916 SP series. It seems incongruous that every Ferrari F40 owner does not own a Ducati 916 SP, or at the very least a Ducati 996 SPS.

It’s hard to understand why this is the case when Ducati have such strong links to Ferrari, the 916/996 SP series started just after the F40 series and the two have so much in common through racing and styling. What is for sure is that this will change as classic motorcycles become such a serious, tangible asset and become much more respected by investors. The way classic motorcycles have increased in value since 2010 and the way the market has divided into investment-grade classic motorcycles and everything else proves this change in demand.

Ferrari F40 prices vary widely, but investment-grade examples are around the £2,000,000 mark. An investment grade Ducati 916 SP is about £35,000 and upwards, depending on series and year. You can buy them for much less, but as my customers have discovered, good luck with that, as you really do get what you pay for. The 916 SP series are around less than 1-2.25% of the value of the equivalent Ferrari F40, so they clearly have a long, long way to go as far as values go. Over time, it’s clear that Ferrari F40 owners will hunt down investment-grade Ducati 916 SP and 996 SPS series motorcycles because their F40 will be incomplete without this equally iconic Ducati.

Classic car investors

Since 2017 classic car investors have been starting to enjoy classic motorcycle ownership because of the incredible value the bikes offer and the future returns are obvious to see and as we wrote about in classic car buyers move in on the good value in classic motorcycles in this article in back in early 2019. The motorcycles also offer a larger global audience because they are not affected by left or right-hand drive. They take up far less space than cars and are easier and more cost-effective to move around the world.

Motorcycles have struggled to shake off their oily rag and Hell’s Angel image from the minds of investors who have memories of cold, wet nights on their motorcycles in the 1970s or 1980s. However, with motorcycle brands such as Harley-Davidson and Ducati having grown into lifestyle brands since the mid-1990s, motorcycles have come much more into the awareness of the public as machines of great beauty. They appear in television programs, films and adverts, with Kiera Knightly appearing on a classic Ducati for a perfume company. More and more companies are wanting to be associated with beautiful motorcycles and the slightly unbridled theme and edge they offer.

Classic motorcycle demographics

Classic motorcycle demographics have been shifting, with British motorcycles of diminishing interest and Japanese and Italian classic motorcycles of more interest to investors over the last thirteen years.

Another interesting shift in demographics is that women motorcyclists have increased global sales by 35% between 2008 and 2018. Many of these female riders are, surprisingly, over sixty years of age. The average age of motorcyclists is now fifty years of age, so there’s clearly a need to get young people back on bikes.

This is a challenge being taken on by the Vintage Motorcycle Club of GB, which I am working on with them to ensure more young riders enjoy the magic of two wheels. The cost and restrictions of accessing motorcycling have reduced the number of young riders taking up this joyous pastime, but action is being taken in the industry to address this.

New global motorcycle demands

There are new global motorcycle demands which indicate where the classic motorcycle market is heading. We work in the parallel market by wholesaling new motorcycles to meet export demands, as well as specialising in investment-grade classic motorcycles.

China has been snapping up as many new motorcycles as can be acquired. Most people in China start on a motorcycle and have done for many decades. They have the largest motorcycle market on the planet, with sales of 20,000,000 new motorcycles a year. Until 1997 they were riding small-capacity Japanese motorcycles until the importation was banned overnight to stimulate home market manufacturers and to elicit more foreign currency reserves through exporting their machines. Restrictions on importing new motorcycles have now been dropped and demand is exceptionally high for new machines. It won’t be long until they are allowed to import used motorcycles and, with that, classic motorcycles and classic cars. China understands the collectables market better than most and once the demand starts for classic motorcycles and cars, prices will become unrecognisable.

India is another enormous motorcycle market with sales of 16.2 million a year and they are demanding new motorcycles only for their parallel market. The Indian market is more restrictive with large import duties, but there is still enormous demand for new motorcycles only, especially large-capacity BMWs. Like China, used motorcycles cannot be imported into India but this will change over time. The collectables market is not as popular in India as it is in China, so the demand for classic motorcycles will take a lot longer to establish there, but it is an inevitability.

The classic cars that will increase in value are classic motorcycles

The classic cars that will increase in value are classic motorcycles, clearly, as there is so much catching up to do to close the gap with classic cars, as values are so far behind. The classic motorcycle market is developing but has a long way to go and will offer unimaginable profits and joy over the coming decades.

This is a global market and what is most surprising is that prices for the top of the market classic cars have not climbed higher quicker. There were only 39 Ferrari 250 GTOs built to begin with, yet there are over 3,000 billionaires on the planet. How long until we have the first billion-dollar classic car sale?

Not as long as many believe, I suspect. Classic motorcycle prices are ready to explode and have got so much headroom that now is clearly the time to get into this exciting market.

Looking for bargains is not the way to ensure you acquire an investment-grade classic motorcycle or car. Bargains are bargains for a reason, and being a guardian of history, which is what ownership is all about, is all about authenticity. Who wants to own a fake Van Gogh?

It’s not about how cheaply you buy the vehicle; it’s about how much you sell it for when the time comes. Try to save a few thousand here and there will only end in tears. It is clear the classic cars that will increase in value are classic motorcycles for the best possible future returns.

If you’re interested in acquiring an investment-grade classic motorcycle or want to understand the classic motorcycle investment market, contact The Motorcycle Broker using the form below. You can call us during office hours on 01364 649027 or 07971 497615.

You can also join The Inside Line for free, where you can enjoy longer versions of our articles, off-market motorcycle sales and our newsletters. We never send out spam and we don’t share your data.

- Most collectible Ducati 916 SP - June 20, 2024

- Classic Motorcycles: To ride or not to ride? - June 17, 2024

- Classic Motorcycles: To ride or not to ride? - June 17, 2024

Leave a Reply